Understanding What Caused the Mazagon Dock Shipbuilders’ Stock to Drop by 50%

On December 27, 2024, Mazagon Dock Sailors Limited (MAZDOCK) saw a 50% decrease in its share price on some exchanges. This dramatic plunge raises the curiosity of investors, wondering why. It is necessary to look into individual stocks and the entire market in order to explain this drastic change in price.

A Brief Background on Mazagon Dock Sailors

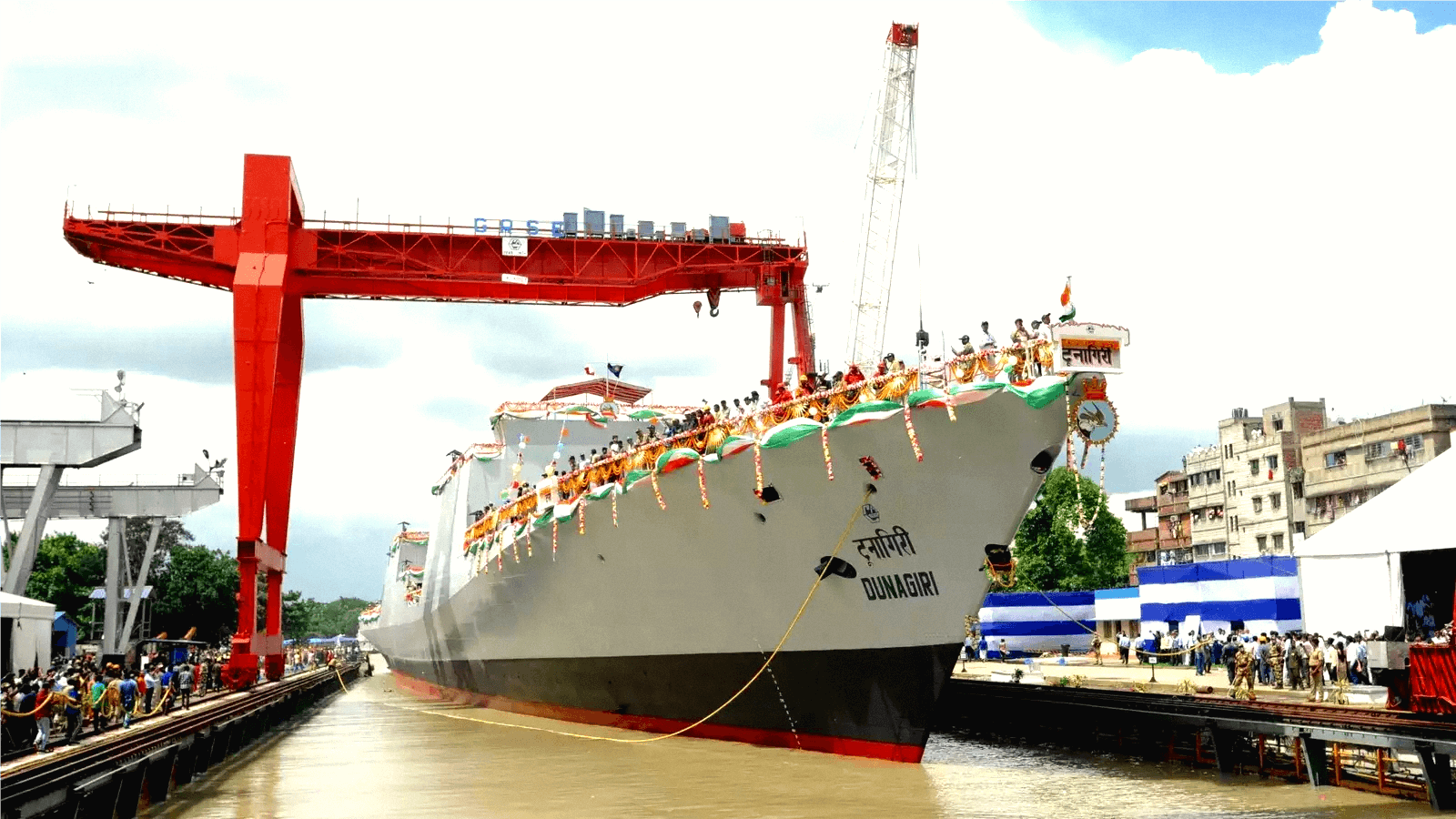

Mazagon Dock Shipbuilders Limited is a defense public sector unit which was incorporated in 1774 and is most famous in India. It makes orders for the construction of Warships, submarines, and Offshore platforms by the Indian Navy and other defense agencies. This enterprise is key to the marine wing of Indian defense. Hence, it is an important firm for defense and shipbuilding in India.

While Mazagon Dock has performed strongly in the market, it’s shares have seen some volatility, more specifically the price shot up after December 27 2024. This drastic drop in share price had many investors and analysts on the lookout for the company but no clear reason for that drop emerged.

Announcement of the Stock Split and Ex Date

The decline of share price may have been triggered by Mazagon Dock Shipbuilders which announced stock split 1:2 thereby increasing the amount of issued stock. This means that each share of the Company stock’s face amount had dropped from ₹10 to ₹5 for Mazagon Dock.

As per records, Mazagon Dock held the record of the stock split on December 27, 2024 and the ex-date was the day prior, December 26, 2024. Usually the stock price tends to dip after this technical adjustment.

The share price changes after the stock splits.

Changes in stock prices always happen because of events such as stock splits. Investors will have the same value of their shareholdings but in the case of a one for two stock split, a share’s price will be halved. This means that a share that was trading at 4,795 before the split will be 2,397.50 after the split. This circumstance doesn’t change the investor’s total investment even though they own twice as many shares

As a result of this readjustment, most investors will treat the combatant shares with lower prices the same as combatant shares of other businesses with higher share prices though both businesses possess the same baseline value. This readjustment of stock price post stock split absolute having lose the share price by fifty percent may have been responsible for the twenty two percent cut December 27th stock price achieved.

Broader Market Factors

In addition to the stock split event, one would expect the stock price of Mazagon Dock’s stock to be influenced by other factors. Geopolitical tensions, government policies and military budgets affect Mazagon Dock and the defence industry as a whole. Any set back in these areas would impact sentiment of the investors where there will be stock price fluctuations.

Indian companies are perceived to be attractive by foreign investors and hence stock prices are also determined by international factors like forex rates, interest rates and inflation. Socio-economic factors and correction of certain bullish scenarios and economic circumstances could lead to massive sell offs particularly for growth or cyclical stocks.

Investor Sentiment and Speculation

Most people believe that a stock split is always beneficial for trading in the stock market. There is a tendency of stock prices to decline and then bounce back due to the belief of investors that the stock has lower price risk and would be able to leverage on a huge price point increase. More so, investors seem to be extremely positive because if there is a possibility of a stock bouncing back there is also the possibility of a short term spike in price.

If mass investors offload their positions in anticipation of a market drop, the price fall will get exacerbated. However, the 50% price fall could rather be attributed towards the behavior of shareholders rather the effect a stock split would have on the company in the long term.

Conclusion

Mazagon Dock Shipbuilders witnessed a significant decline in share value, amounting to around 50%. This fall was recorded in the span of a day following the announcement of a stock split. This might hinge on the notion that many investors feel that stock splits are in some way necessary, despite the downside that they create per share valuations. Investors must purely observe the company stock market trends and fundamentals with a bias that such interventions are illogical in the long term.

The long-term vision of the company coupled with the defense roles it has in India is probably more pressing than worrying about the impact of a stock split. Markets tend to have short attention spans and thus compensate illogical stock settings borne from splits through volatility in price. It is always prudent that an investor consults a financial advisor to seek clarity on how to react and move amid stocks implementing a split.

If you are interested for more: “Mazagon Dock Shipbuilders: Resilient Amidst Market Fluctuations with Strong Growth Potential” – FLASH UPDATES “2025 Honda Unicorn: Unleashing Performance, Style, and Inn

Leave a Reply